In today’s business world, managing payroll is a fundamental yet complex task that requires accuracy, efficiency, and compliance. Paycor Payroll is a comprehensive payroll management system designed to simplify these processes for businesses of all sizes. By offering advanced automation, compliance tools, and user-friendly features, Paycor has established itself as a leader in human capital management (HCM). This article delves into the features, benefits, and impact of Paycor Payroll on modern businesses.

Understanding Paycor Payroll

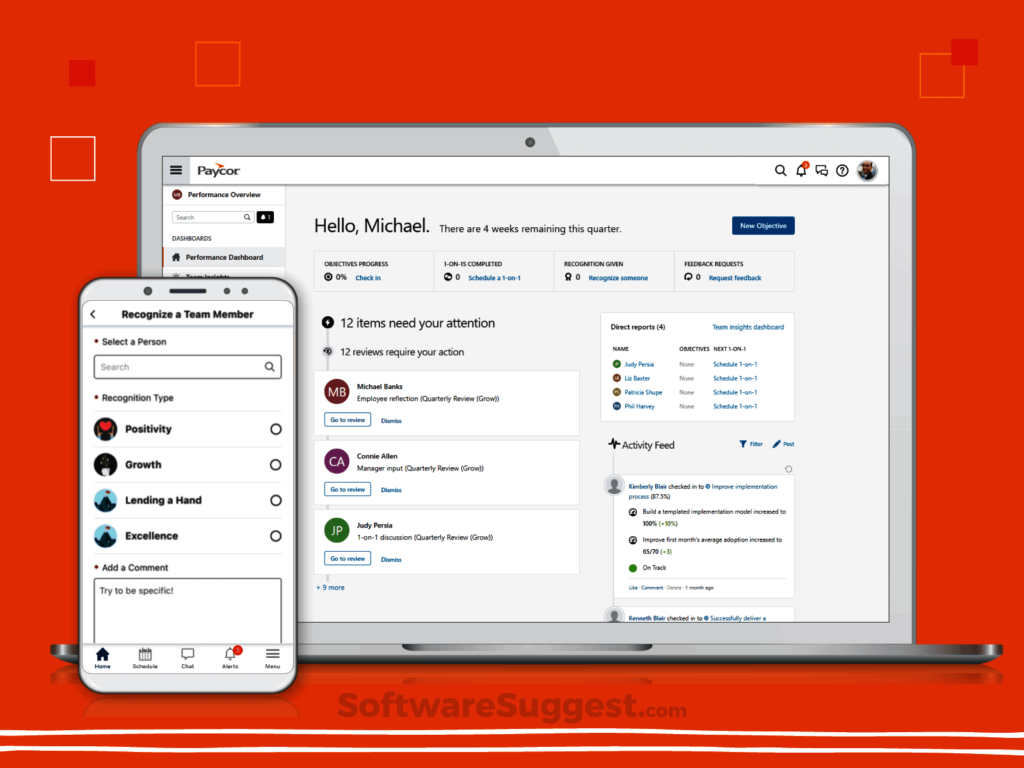

Paycor payroll is part of the broader Paycor HCM platform, which integrates payroll, HR, time tracking, and benefits administration into a single cloud-based solution. Its primary goal is to automate payroll processing, ensure regulatory compliance, and provide employers and employees with intuitive tools to manage their payroll-related tasks seamlessly.

Key Features of Paycor Payroll

1. Automated Payroll Processing

One of Paycor’s core strengths is its ability to automate payroll calculations. Businesses can set up the system to account for various factors, including salaries, hourly wages, overtime, bonuses, and deductions. Once configured, Paycor automates the calculations, ensuring accuracy and timeliness in payroll delivery.

2. Tax Compliance and Filing

Navigating the complexities of payroll taxes is a significant challenge for many businesses. Paycor addresses this by automatically calculating federal, state, and local taxes. The platform stays up-to-date with the latest tax regulations and handles tax filings, including forms like W-2s, 1099s, and 941s. This feature minimizes the risk of errors and penalties, giving businesses peace of mind.

3. Employee Self-Service Portal

Paycor empowers employees through a self-service portal, which allows them to:

- View and download pay stubs.

- Access year-end tax documents.

- Update personal information, such as banking details for direct deposit.

- Track vacation and sick leave balances.

- Request time off.

This self-service functionality reduces administrative burdens on HR teams while enhancing employee satisfaction.

4. Direct Deposit and Flexible Payment Options

Paycor supports multiple payment methods, including direct deposit, printed checks, and pay cards. Employees can choose their preferred method, and businesses can process payroll efficiently. Direct deposit ensures timely and secure payments, while pay cards offer an alternative for unbanked employees.

5. Real-Time Reporting and Analytics

With Paycor, businesses gain access to a suite of customizable reports. These reports provide insights into payroll costs, tax liabilities, and labor distribution, helping organizations make informed financial decisions. Real-time data ensures businesses can monitor payroll trends and address issues promptly.

6. Integration with Time and Attendance Systems

Paycor integrates seamlessly with its time and attendance tracking tools, eliminating the need for manual data entry. Time worked, overtime, and shift differentials are automatically factored into payroll calculations, ensuring accuracy and efficiency.

7. Mobile Accessibility

Paycor’s mobile app enables payroll administrators and employees to access the platform on the go. Employers can run payroll, approve timesheets, and generate reports, while employees can view pay stubs and request time off from their smartphones.

Benefits of Using Paycor Payroll

1. Time Savings

Automating payroll processes significantly reduces the time spent on manual tasks. By streamlining calculations, tax filings, and reporting, Paycor allows HR and finance teams to focus on strategic initiatives.

2. Cost Efficiency

By minimizing errors and reducing administrative workload, Paycor Payroll helps businesses save money. Its automated compliance tools also reduce the likelihood of costly fines and penalties related to tax errors.

3. Improved Accuracy

Manual payroll processing is prone to errors, which can lead to employee dissatisfaction and regulatory issues. Paycor’s automation ensures that calculations are accurate, reducing the likelihood of mistakes.

4. Enhanced Employee Experience

The employee self-service portal and mobile accessibility provide transparency and convenience. Employees appreciate having instant access to their payroll information and the ability to manage their details independently.

5. Scalability

Paycor Payroll is designed to grow with businesses. Whether a company has ten employees or ten thousand, the platform’s scalability ensures it can handle evolving payroll needs.

6. Compliance Assurance

Staying compliant with tax regulations and labor laws is a top priority for businesses. Paycor’s built-in compliance features and automatic updates help organizations avoid penalties and legal complications.

Use Cases for Paycor Payroll

Small Businesses

For small businesses with limited HR resources, Paycor simplifies payroll management by automating calculations and filings. Its intuitive interface ensures ease of use, even for those without extensive payroll experience.

Mid-Sized Companies

Mid-sized organizations benefit from Paycor’s robust reporting tools, which provide insights into labor costs and support strategic decision-making. The platform’s scalability allows these businesses to accommodate growth.

Large Enterprises

Large organizations with complex payroll structures rely on Paycor for its ability to handle multi-state tax compliance, diverse pay types, and extensive reporting needs. Its integration capabilities ensure seamless workflows across departments.

Nonprofits

Nonprofit organizations often operate on tight budgets and need cost-effective solutions. Paycor’s automation and compliance tools help nonprofits manage payroll efficiently while adhering to tax-exempt regulations.

Challenges Addressed by Paycor Payroll

Compliance Risks

Tax laws and labor regulations are constantly evolving, making compliance a moving target. Paycor mitigates these risks by ensuring that businesses stay up-to-date with the latest requirements and automating tax filings.

Error Reduction

Human errors in payroll processing can lead to significant financial and reputational consequences. Paycor’s automated calculations and built-in error checks minimize mistakes.

Administrative Burden

Managing payroll manually is time-intensive and often requires significant administrative effort. Paycor’s automation reduces this burden, freeing up HR and finance teams for higher-value tasks.

Employee Dissatisfaction

Late or incorrect paychecks can erode trust between employers and employees. Paycor’s reliable processing and self-service tools ensure employees are paid accurately and on time, boosting morale.

Steps to Implement Paycor Payroll

Implementing Paycor Payroll involves the following steps:

- Assessment: Evaluate your organization’s payroll needs, including employee count, pay structures, and compliance requirements.

- Onboarding: Work with Paycor’s implementation team to set up the system, configure payroll rules, and import employee data.

- Training: Train HR staff and payroll administrators on using the platform effectively.

- Integration: Connect Paycor with existing systems, such as time tracking and accounting software, to ensure seamless workflows.

- Launch: Begin processing payroll using Paycor, leveraging its automation and reporting tools.

Future of Payroll with Paycor

As businesses continue to embrace digital transformation, solutions like Paycor Payroll are becoming indispensable. The platform’s focus on automation, compliance, and user experience positions it as a leader in the evolving payroll landscape. Future enhancements, such as AI-driven analytics and deeper integrations, are likely to further streamline payroll management and provide even greater value to businesses.

Conclusion

Paycor Payroll is more than just a payroll processing tool; it’s a comprehensive solution designed to simplify workforce management and enhance business efficiency. By automating time-consuming tasks, ensuring compliance, and providing user-friendly features, Paycor empowers businesses to focus on growth and innovation. Whether you’re a small startup or a large enterprise, Paycor Payroll offers the tools and support needed to navigate the complexities of payroll with confidence.